Introduction

Taxation is a fundamental concept in economics and public finance. For students, understanding what taxes are, their types, and how they function is essential for exams and general awareness. This comprehensive article explains what a tax is, why governments levy taxes, the differences between direct and indirect taxes, and their respective merits and demerits.

Table of Contents

What is Tax?

A tax is a compulsory financial contribution imposed by a government on individuals, businesses, or goods and services. Taxes generate revenue for the government to spend on public goods and services such as infrastructure, education, healthcare, defense, and welfare schemes.

Economist Seligman defined tax as “a compulsory contribution from a person to the government to defray the expenses incurred in the common interest of all, without reference to special benefits conferred.”

Key features of a tax:

- It is mandatory.

- Imposed by a government or statutory authority.

- Paid without direct benefit to the payer.

- Utilized for collective public welfare.

Why Do Governments Levy Taxes?

Taxes serve several purposes:

- Revenue Generation: The main source of government income.

- Redistribution of Income: Taxes help reduce economic inequality by taxing the rich more heavily and using funds for social welfare.

- Regulation: Taxes can control harmful activities, like tobacco consumption.

- Economic Stability: Taxation helps control inflation or recession.

- Development: In developing countries, taxes fund infrastructure and development projects.

Classification of Taxes

Taxes are broadly classified as direct and indirect taxes. This is a fundamental classification studied in economics.

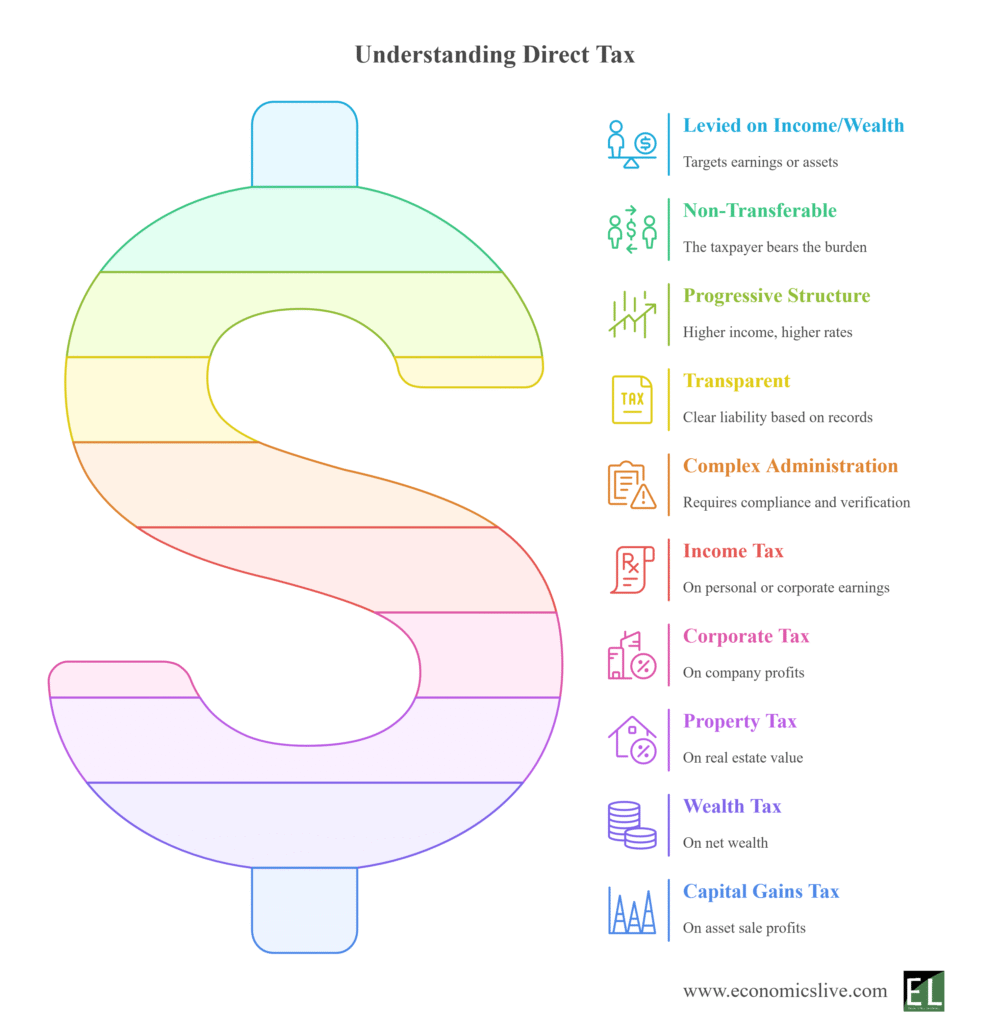

Direct Tax

A direct tax is imposed directly on individuals or organizations and cannot be shifted to others. The taxpayer bears the entire burden.

Examples of Direct Taxes in India:

- Income Tax

- Corporate Tax

- Property Tax

- Capital Gains Tax

- Securities Transaction Tax (STT)

Characteristics of Direct Taxes:

- Based on ability to pay.

- Progressive in nature.

- Burden cannot be shifted.

- Require filing returns and self-assessment.

Advantages of Direct Taxes:

- Promote equality by taxing higher incomes at higher rates.

- Certain and elastic; revenue increases as economy grows.

- Reduce consumption and inflationary pressures.

- Encourage responsible citizenship.

Disadvantages of Direct Taxes:

- High rates may discourage saving and investment.

- Complex to assess and collect.

- Risk of evasion.

- Unpopular among taxpayers.

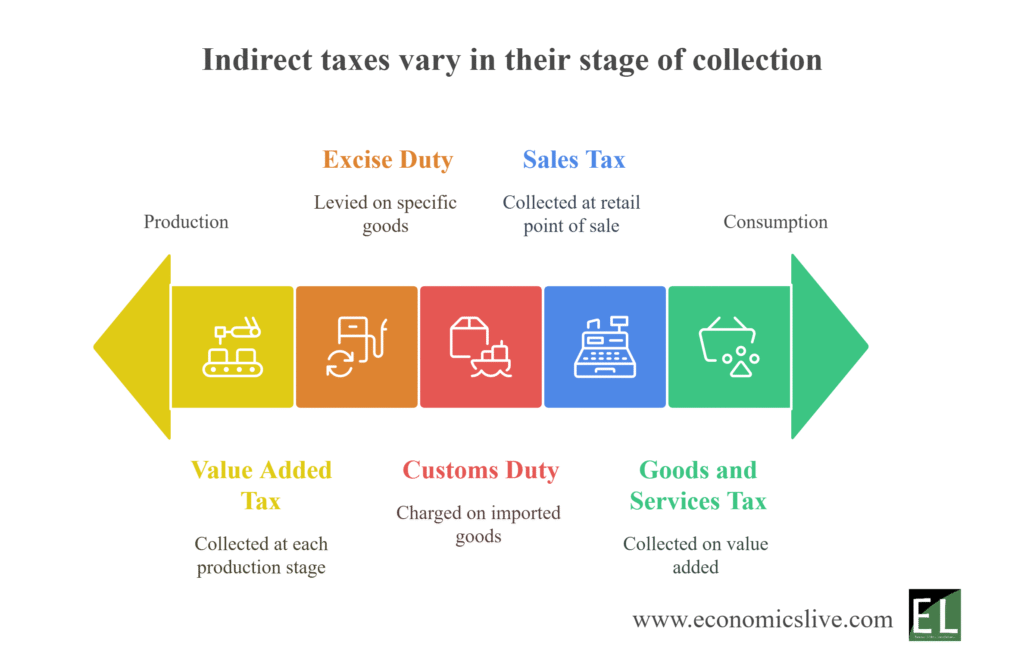

Indirect Tax

An indirect tax is imposed on goods and services rather than on income or property. The burden can be shifted from the producer or seller to the final consumer through higher prices.

Examples of Indirect Taxes in India:

- Goods and Services Tax (GST)

- Customs Duty

- Excise Duty (mostly subsumed under GST)

- Entertainment Tax (in some local bodies)

- Stamp Duty (on property transfer)

Characteristics of Indirect Taxes:

- Collected by intermediaries (sellers) and remitted to the government.

- Uniform rate regardless of income.

- Burden passed to consumers.

- Convenient to pay and collect.

Advantages of Indirect Taxes:

- Convenient; paid in small amounts with purchases.

- Less evasion compared to direct taxes.

- Widens tax base; everyone contributes.

- Can regulate consumption patterns.

Disadvantages of Indirect Taxes:

- Regressive; poor and rich pay the same rate.

- Can cause price inflation.

- Before GST, cascading effect increased final cost.

- Less equitable than direct taxes.

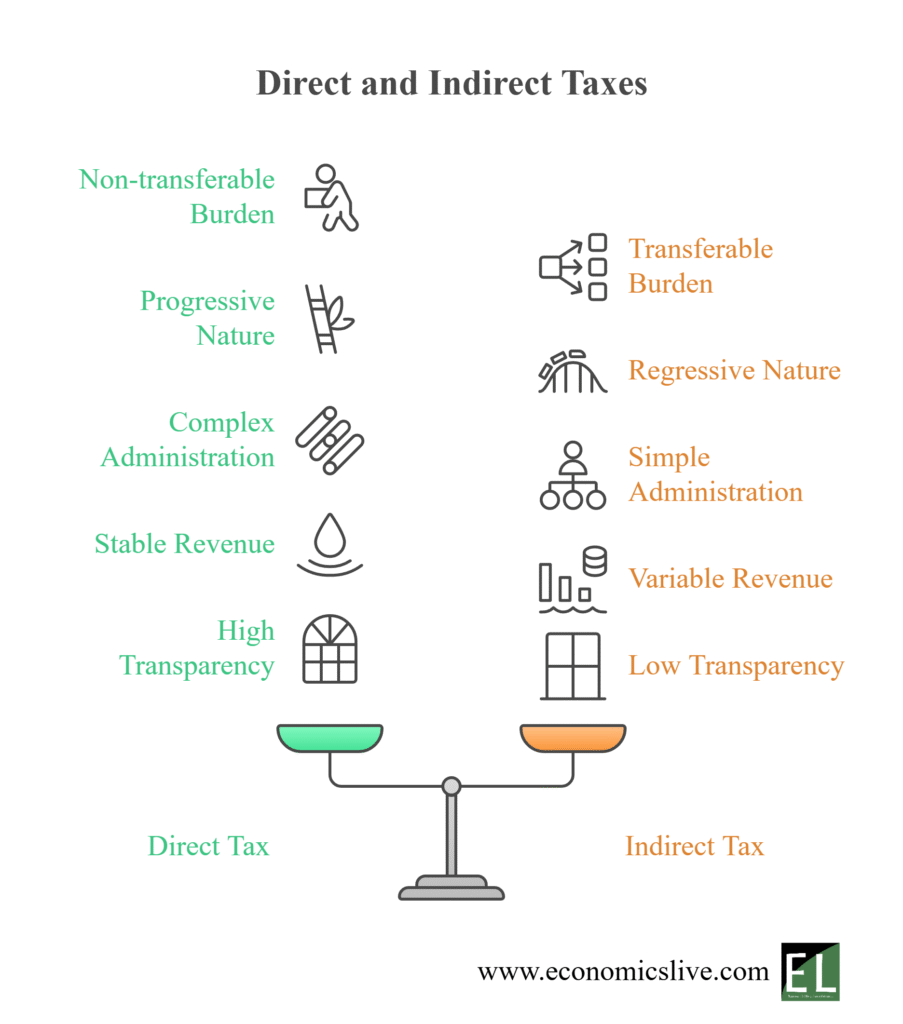

Detailed Comparison: Direct vs Indirect Taxes

| Feature | Direct Tax | Indirect Tax |

|---|---|---|

| Definition | Tax on income, wealth, or property | Tax on goods and services |

| Burden | Cannot be shifted | Shifted to consumers |

| Equity | Progressive, based on ability to pay | Regressive, same rate for all |

| Incidence and Impact | On same person | On different persons |

| Visibility | Explicit and visible | Hidden in product prices |

| Evasion | Higher possibility | Less chance |

| Administrative Cost | Higher | Lower |

| Elasticity | More elastic | Less elastic |

| Examples | Income Tax, Corporate Tax | GST, Customs Duty, Excise Duty |

Historical Context: Taxation in India

India’s tax system evolved from ancient to modern times:

- Ancient India: Kautilya’s Arthashastra detailed tax principles for welfare.

- Colonial Period: Heavy land revenue under British rule.

- Post-Independence: Emphasis on progressive direct taxes and excise duties.

- 1991 Reforms: Tax rationalization for liberalization.

- 2017 GST: Major reform, unified indirect taxes under one umbrella, simplified compliance, and eliminated cascading effect.

Role of Taxes in Economic Development

Taxes play multiple roles in economic progress:

- Revenue Effect: Funding for infrastructure, education, health, defense.

- Redistribution: Progressive taxes reduce income gaps.

- Regulation: Sin taxes control harmful goods.

- Stabilization: Used as fiscal tools to manage economic cycles.

- Allocation: Incentives encourage investment in priority sectors.

Direct and Indirect Taxes in India: Practical Examples

Direct Tax Example:

Mr. A earns Rs. 10 lakh per annum. Based on the income tax slabs, he pays income tax directly to the government through self-assessment or TDS.

Indirect Tax Example:

A consumer buys a mobile phone worth Rs. 20,000. The price includes 18% GST. The seller collects GST from the buyer and deposits it with the government.

Reforms and Current Trends

India continues to refine its tax structure to increase compliance, reduce evasion, and attract investment. Key recent developments include:

- Simplification of income tax return filing.

- Introduction of faceless assessment to reduce corruption.

- Expansion of GST to bring more goods and services under its net.

- Incentives for digital payments to trace transactions.

Common Myths and Facts about Taxes

| Myth | Fact |

|---|---|

| Only the rich pay taxes | Everyone contributes through direct or indirect taxes. |

| GST is a direct tax | GST is an indirect tax included in the price of goods and services. |

| Avoiding taxes is smart | Tax evasion is illegal and punishable. |

| High taxes harm the economy | Well-structured taxes fund development and welfare. |

Conclusion

A clear understanding of direct and indirect taxes is essential for economics students and every responsible citizen. Taxes are vital for economic growth, equity, and public welfare. While direct taxes promote social justice by taxing according to capacity, indirect taxes ensure a wide coverage and are easier to collect. An efficient tax system balances both types, ensuring adequate revenue, minimal distortion, and economic stability.

Key Takeaway

Taxes are the backbone of a nation’s development. They not only finance government spending but also shape economic behavior and contribute to the overall welfare of society.