Table of Contents

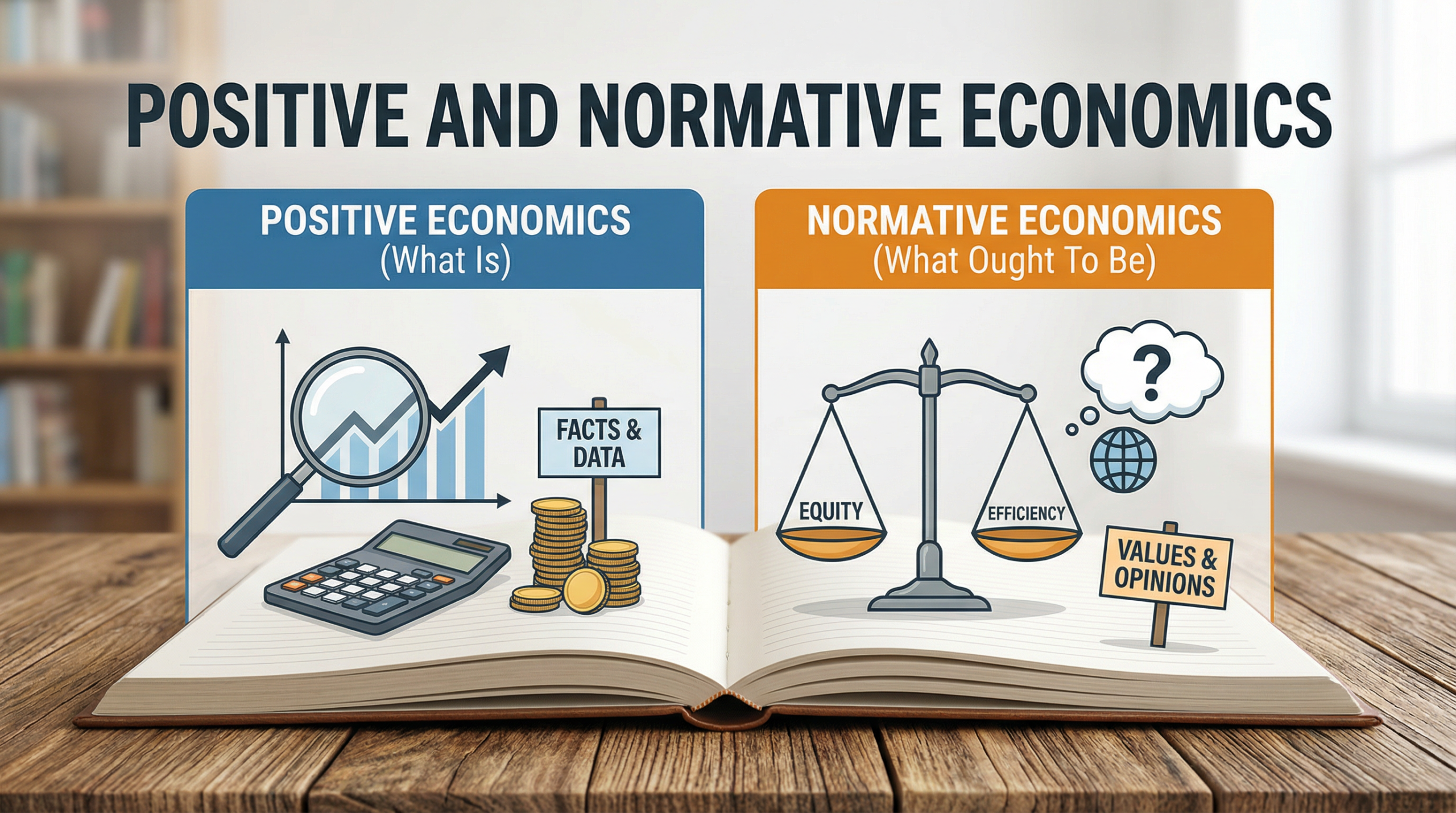

What is Positive Economics?

(The Science of “What Is”)

Positive economics is the branch that describes and explains economic phenomena as they actually are or were, without any value judgments. It is purely objective and scientific, exactly like physics and chemistry.

A positive statement can be:

- True or false

- Tested or falsified using data

- Proven with empirical evidence

It only answers three types of questions:

- What is?

- What was?

- What will be? (if certain conditions hold)

Real-life positive statements from the recent Indian economy (2024–2025):

- “India’s GDP grew at 6.7% in the first quarter of FY 2024-25.” → Verifiable from the MOSPI data.

- “A 1% increase in repo rate by RBI led to a 0.4% reduction in credit growth in the subsequent two quarters (2022–2024 evidence).” → Testable hypothesis.

- “The female labour force participation rate rose from 23.3% in 2017-18 to 41.6% in 2023-24 according to Periodic Labour Force Survey (PLFS).” → Pure fact.

- “India’s fiscal deficit stood at 5.1% of GDP in the Revised Estimates of 2024-25.” → Official government figure.

- “Import dependence on electronic components fell from 78% in 2014 to 52% in 2024 after the PLI scheme.” → Data-driven.

Notably, none of these statements tell us whether the situation is good or bad. They simply state “what is.”

This is why Milton Friedman famously called positive economics “an objective science” in his 1953 essay The Methodology of Positive Economics.

Key Characteristics of Positive Economics

- Objective: It relies on data, logic, and evidence to make decisions.

- Descriptive: It describes the state of the world.

- Causal: It focuses on cause-and-effect relationships (e.g., “If X happens, Y will follow”).

- Value-free: It avoids personal opinions.

In research papers, positive economics is usually found in the “Results” and “Data Analysis” sections. It is the “hard” math behind the theory.

What is Normative Economics?

(The Art of “What Ought to Be”)

Normative economics is the branch that makes value judgements and prescribes what economic goals or policies should be. It is inherently subjective because it depends on personal ethics, ideologies, and beliefs about fairness, justice, and welfare.

A normative statement cannot be proven right or wrong scientifically; it can only be debated.

It answers only one type of question: What ought to be?

Recent normative statements you hear daily in Indian debates:

- “The government should reduce fiscal deficit to below 4.5% — 5.1% is too high and irresponsible.”

- “Female LFPR of 41.6% is still shamefully low; India must aim for at least 60%.”

- “Universal Basic Income should be introduced to eliminate poverty.”

- “Cryptocurrency trading should be completely banned to protect retail investors.”

- “The rich should pay 45% income tax because extreme inequality is morally unacceptable.”

- “Free electricity and free bus rides for women are populist freebies and must be stopped.”

Words that instantly reveal a normative statement: should, must, ought to, better, fair, unfair, just, unjust, good, bad, morally right, shameful, irresponsible, etc.

Key Characteristics of Normative Economics

- Subjective: Based on individual or collective preferences.

- Prescriptive: It recommends specific actions or policies to be implemented.

- Untestable: You cannot mathematically prove an opinion to be correct.

In thesis or essays, normative economics is usually found in the “Policy Recommendations” or “Conclusion” sections. This is where you argue why the data are important.

Positive vs Normative Economics

| Parameter | Positive Economics | Normative Economics |

| Nature | Objective, scientific | Subjective, value-laden |

| Focus | Description, explanation, prediction | Prescription, recommendation |

| Core Question | What is? / What will be? | What ought to be? |

| Testability | Can be tested/falsified with data | Cannot be tested — only debated |

| Value Judgement | Absent | Always present |

| Example (2024 context) | “India’s CAD was 1.2% of GDP in Q1 2024-25.” | “Current account deficit should never exceed 2%.” |

| Methodology | Empirical, econometric, data-driven | Ethical, philosophical, ideological |

| Used by | Researchers, forecasters, central banks | Policymakers, activists, opinion makers |

| Accepted in top journals | Yes (main results) | Rarely (only in editorials or policy sections) |